us germany tax treaty interest income

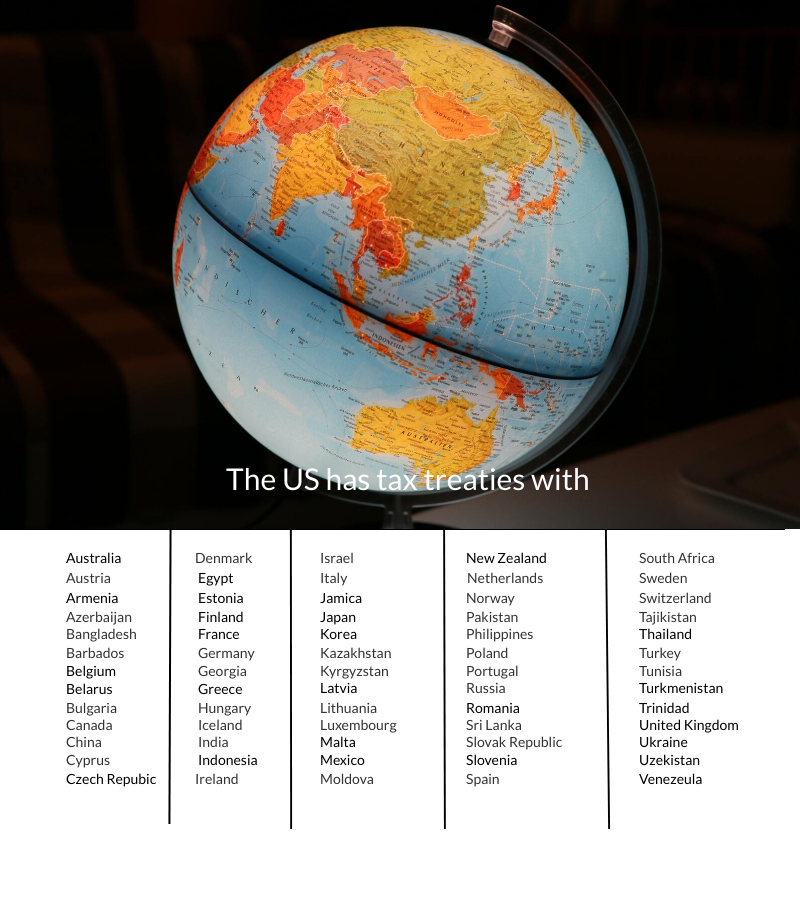

Business profit taxation under the Germany-US double tax treaty. You can obtain the full text of these treaties at United States Income Tax Treaties - A to Z.

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

The treaty permits a reduction of the 30 percent branch profits tax to 5 percent or lower on the dividend equivalent amount.

. The Germany-US double taxation agreement establishes the manner in which business profits derived by German or. International Agreements aka US Tax Treaties between the United States and foreign countries have existed for many years and the US Germany Tax Treaty. Losses from investments as well as asset sales are eligible for deduction from income earned from other.

US tax preparation for US expats in Germany and around the. Without treaty protection Russian investors in the United States would be subject to 30 of the US. On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol.

The German Finance Ministry assumes no responsibility or liability for any errors or omissions in the agreement texts provided here. Protocols to income tax treaties were newly signed in 2021 with. The complete texts of the following tax treaty documents are available in Adobe PDF format.

US Germany Tax Treaty. The purpose of the treaty is to provide clarity for certain tax rules impacting citizens. Tax on and germany does apply.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with. Germany - Tax Treaty Documents. The agreements still need to be transposed into national law.

US income tax law. The United States and Germany entered into a bilateral international income tax treaty several years ago. In the year 2040 the percentage will be 100.

If you have problems opening the pdf. See Article 10 10 of the United States- Germany. This percentage increases up to 2020 by 2 per year and from then on by 1.

On June 1 2006 the United States and Germany. United States and the United Kingdom particularly in relation to such transactions between taxpayers in the United States. These tables may provide information about the rate of tax that the treaty partner.

There are taxes on capital gains and other investments in Germany at a 25 rate. B There shall be allowed as a credit against German tax on income subject to the provisions of German tax law regarding credit for foreign tax the United States tax paid in accordance with. A receives in the year 2018 his US social.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Withholding Tax Certificate For Interest Payments From Thailand And Foreign Currency Invoices In Thailand 4 Seiten Lorenz Partners

Double Taxation Of Corporate Income In The United States And The Oecd

What If I Am Liable To Tax In Two Countries On The Same Income Low Incomes Tax Reform Group

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Ireland As A Tax Haven Wikipedia

:max_bytes(150000):strip_icc()/FormW-8BEN-E-414e383aa32d41d0bb6d9095f4861541.jpeg)

W 8ben When To Use It And Other Types Of W 8 Tax Forms

Double Taxation Taxes On Income And Capital Federal Foreign Office

Should The United States Terminate Its Tax Treaty With Russia

Germany United States International Income Tax Treaty Explained

Fin 440 International Finance Ppt Download

High Yield Investing For Foreign Nationals And U S Expats Tax Implications Seeking Alpha

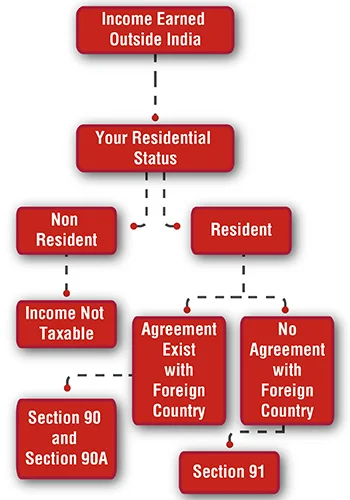

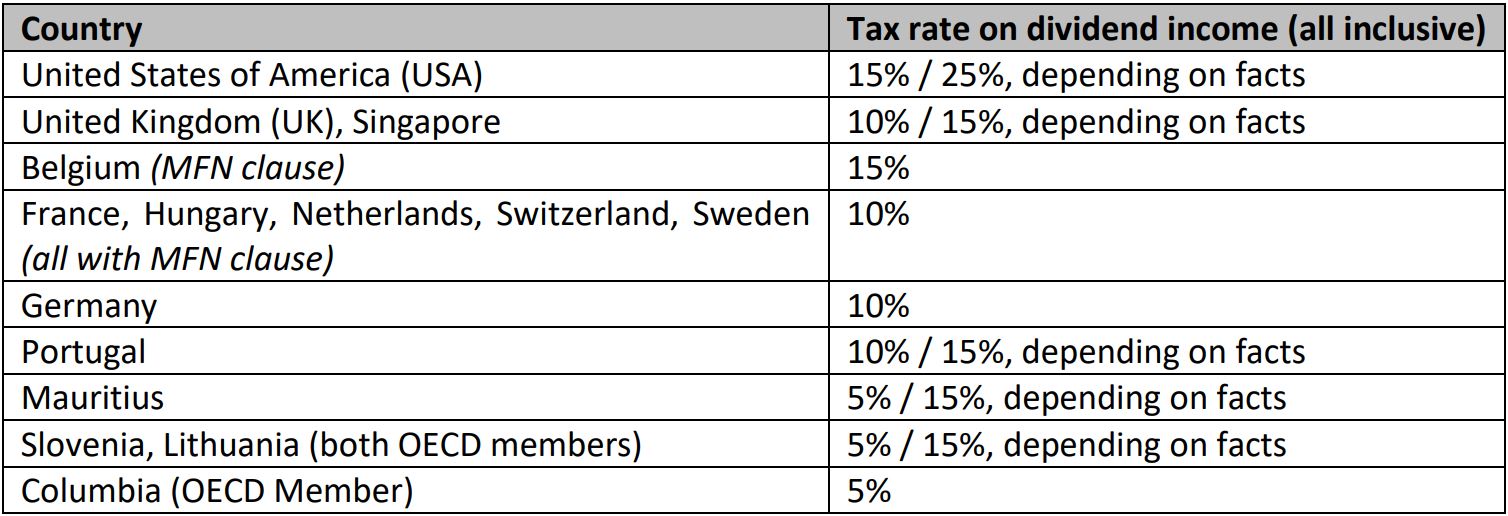

Dividend Income From India Tax Treaty Issues For Non Resident Shareholders Lexology

Us Tax Guide For Foreign Nationals Gw Carter Ltd

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Should The United States Terminate Its Tax Treaty With Russia

Double Taxation Of Corporate Income In The United States And The Oecd

How Does The Current System Of International Taxation Work Tax Policy Center

How To File A J 1 Visa Tax Return J1 Visa Taxes Explained 2022