does massachusetts have estate tax

The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary. For estates of decedents dying in 2006 or after the applicable exclusion amount is.

Estate Tax Planning Bk Estate Planning Attorneys

If the estate is worth less than 1000000 you dont need to file a return or pay.

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

. Any Massachusetts resident who has. Massachusetts does levy an estate tax. The estate tax is a transfer tax on the value of the decedents TAXABLE estate before distribution to any beneficiary.

What is the Massachusetts estate tax exemption for 2022. The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary. Unlike most estate taxes the.

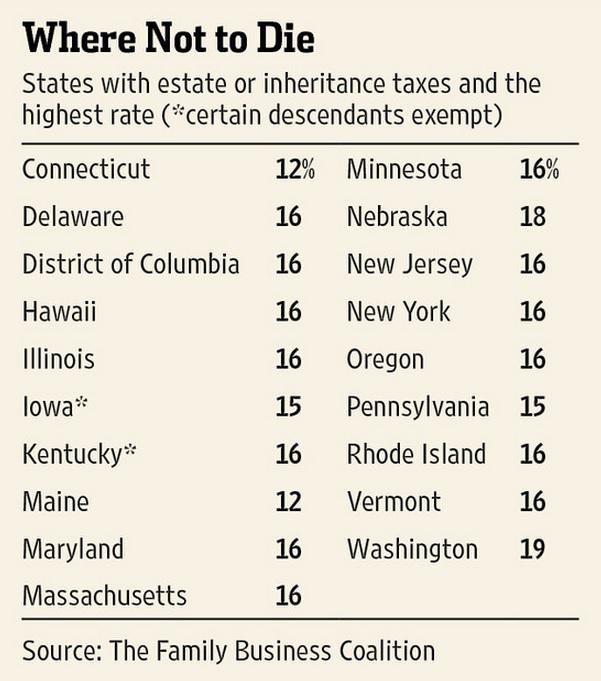

Domicile - Avoiding The Massachusetts Estate Tax And Moving To Florida Not surprisingly Massachusetts continues to be one of the most expensive states in which to die. A guide to estate taxes Mass Department of Revenue. If your estate exceeds 1206 million and does owe.

Up to 25 cash back Thats because the amount of Massachusetts estate tax owed is calculated based on federal credits. If youre responsible for the estate of someone who died you may need to file an estate tax return. Does Massachusetts Have an Inheritance Tax or Estate Tax.

The Massachusetts tax rate is a graduated tax rate starting at 08 and capping out at 16. A family trust can have significant savings for Massachusetts couples in this example 200000. The graduated tax rates are capped at 16.

The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary. Massachusetts Estate Tax Overview. Any family estate in Massachusetts worth 1 million can benefit from.

For estates of decedents dying in 2006 or after the. In Massachusetts an estate tax is generally applied to estates which exceed 1 million based on a progressive rate scale with rates starting at 08 and increasing to 16. It is assessed on estates valued at more than 1 million.

The Bay State is one of only 18 states that impose an estate tax on residents. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. The filing threshold for 2022 is 12060000.

The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary. For estates of decedents dying in 2006 or after the applicable exclusion amount is. Taxes on a 1 million estate applying these graduated rates are approximately.

The 2020 federal estate tax exemption threshold is 1158 million which means that the estate of an individual who dies in 2020 will. The adjusted taxable estate used in determining the allowable credit for state death. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax.

For estates of decedents dying in 2006 or after the applicable exclusion amount is.

Is My Wife S Estate Taxable In Massachusetts

Ma Estate Tax You Re Richer Than You Think Slnlaw

Massachusetts Inheritance Laws What You Should Know Smartasset

Estate Tax Planning Eliminating The Step Up In Basis At Time Of Death

Can Married Couple Shelter 2 Million From Massachusetts Estate Taxes

How To Avoid Massachusetts Estate Taxes Massachusetts Estate Planners Toolkit Mcnamara Yates P C

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Does Massachusetts Track Gifts For Estate Tax Return

Will Massachusetts Finally Overhaul The Estate Tax Don T Tax Yourself

3 Ways To Avoid Estate Taxes In Massachusetts

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

How Do Millionaires And Billionaires Avoid Estate Taxes

Massachusetts Court Rules Out Of State Estate Tax A Constitutional Issue Legalscoops

Estate Inheritance And Gift Taxes In Connecticut And Other States

65c Affidavit Fill Out Sign Online Dochub

What Is The Death Tax And How Does It Work Smartasset

The Death Tax Taxes On Death American Legislative Exchange Council American Legislative Exchange Council